Did you know? The Federal Solar Tax Credit (ITC) dropped in 2020. This is part of a “step down” process in which the tax credit will eventually be eliminated entirely unless it is renewed by Congress. As of January 1, 2020, the Federal Solar Tax Credit saw a 4% drop, decreasing from A 30% credit to a 26% credit.

What Is The Federal Solar Tax Credit?

The Federal Solar or ITC is a tax credit that was passed in 2005 while George W. Bush was in office. Under his administration, the tax credit was made part of the Energy Policy Act. This credit is given to homeowners who have a rooftop solar system installed on their home in a given tax year. The amount of the credit is applied against the cost of the system that is installed (i.e. more expensive system = bigger rebate). The program was designed to incentivize homeowners to consider rooftop solar systems.

What Does The ITC Step Down Mean For Homeowners?

Homeowners that are considering installing rooftop solar panels on their home will see little tax benefit to do so, especially after the ITC steps down again in 2021 to an even lower 22% credit. By 2022, the Federal Solar Tax Credit will only be available for commercial installations at a rate of 10%. That means that homeowners will not see a tax benefit for rooftop installation at all by 2022.

The credit is only for the tax year that the system was installed. Each time the credit steps down, homeowners receive less of a credit on their tax refund. While a 4% decrease this year may not seem like much, that 4% adds up quickly when you consider the cost of purchasing a rooftop solar system for your home. Let’s say the system that you decide to install this year costs $25,000. The credit for 2020 will be $6,500 vs. $7,500 that it would have been just last year in 2019. By 2021, you would only receive a $5,500 credit. Because you can also claim any additional work required to install the system, as well as the batteries required to run it, you also lose 4% on those cost savings too.

What Are Other Renewable Energy Options For Homeowners?

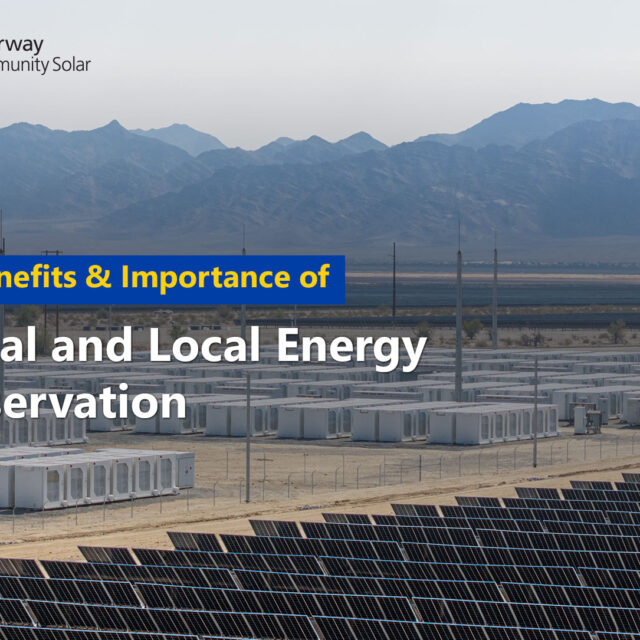

Homeowners that are interested in renewable energy for their home, but are concerned about the cost risks associated with rooftop solar, should consider Community Solar. Community Solar farms get their energy from the same place that rooftop arrays do – the sun. Both sources can offer long-term cost savings and a brighter, more renewable future for generations to come, but Clearway Community Solar does not require any installation and homeowners see savings in their monthly electricity bills instead of an expiring tax credit.

Clearway Community Solar Farms help subsidize the energy load on local municipal power grids, offsetting the cost of delivering it to homes. Homeowners that participate in a local Community Solar project, in turn, receive solar credits that are applied to their monthly electricity bill.

To find out more about how Clearway Community Solar works, click here.